Dear Unitholders,

The Pender Alternative Absolute Return Fund returned 0.3%[1] in July, bringing year-to-date returns to 1.0%.

Credit markets saw tighter spreads in July and positive absolute returns, but by late in the month there were signs of exhaustion as historically expensive spread levels were met with mixed earnings from cyclical market segments and significant new issue supply. The HFRI Credit Index returned 1.2% bringing year-to-date returns to 5.2%. We believe this index likely benefitted from spread compression in investment grade credit markets in July. The ICE/BofA US High Yield Index returned 0.4% in July.

Portfolio & Market Update

While momentum from the strong rally in May and June continued into early July, high yield spreads reached their lows for the month on July 3, a low liquidity day ahead of the US fourth of July holiday. It appeared to us that high yield credit had reached a point of exhaustion with very tight spreads in high quality credits, and areas of concern elsewhere in the market. One of the themes we’ve noticed this year is the expansion of what the market considers to be higher quality as investors reach for yield and spread, often at odds with negative equity market performance in the same capital structure. While complacency in credit markets is high, we are starting to see signs that decompression (i.e. a widening of the basis of risk premiums between lower and higher quality credit) could be taking place in US high yield. BB spreads moved from a low of 160bp on July 3 to 181bp as of August 8, which is still historically expensive but a reversal of the positive momentum we saw in the spring.

The Fund exited our position in Encino Acquisition following the announcement of a call in connection with their acquisition by EOG Resources Inc., resulting in a capital gain for the Fund. In early August, the Fund established a position in Shelf Drilling (Oslo: SHLF) bonds that are expected to be called by the end of this year once the company is acquired by ADES International. At our purchase prices, we expect to earn between a 10-11% yield to call later this year, which is a better return than is available in Shelf’s equity which trades at about a 6% arbitrage yield using our assumed closing date with significantly more downside in the event of a deal break.

The Fund has been active in new issue markets as the US high yield has seen ample supply, some of which has come with attractive new issue concessions.

One of our higher conviction trades currently is a capital structure trade in Rivian Holdings/Rivian Automotive. We own secured bonds issued by Rivian Holdings due in just over five years which trade at a discount to face value and yield around 12% to maturity. We have hedged this position with a smaller short position in Rivian Automotive (Nasdaq: RIVN) equity. Given the higher beta of the equity security, we believe that the position is close to beta neutral. RIVN has an equity market capitalization of about USD$15 billion with a large cash position and support from Volkswagen Group which announced a $5 billion investment late last year. The company benefitted from earlier investments from Amazon.com Inc. (Nasdaq: AMZN) which is still a large equity holder. While the business does consume cash, our experience with smaller automotive OEMs is that there is often equity sponsorship available from existing and new investors who see potential in the business long term. While building an electric vehicle business to sufficient scale to be free cash flow positive is challenging, we believe that there is significantly more optimism priced into the equity than what is being reflected in the high yield bond, and that the hedged package is attractive.

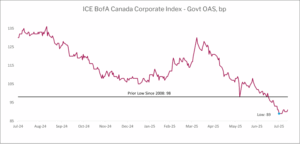

While high yield spreads stalled out early in July, other credit markets continued to rally with limited pushback from investors. Canadian IG spreads rallied through July, with the ICE BofA Canada Corporate Index making a new low in spread since 2007 in early August. Canadian credit markets are often an attractive hiding place after US markets have seen material spread compression, but this is the most stretched we have seen Canadian investment grade credit spreads.

Source: ICE/Bloomberg

The US leveraged loan market saw its heaviest new issue month in history in July, with most of this volume being repricing (at lower spreads) loans that were already in the market. We continued to take sales in our loan book in July and got lucky in that we sold out of our last piece of Greystar’s Term Loan at a premium to par the week before they came to market to reprice the loan from a spread of SOFR + 275bp to SOFR + 250bp. There is some evidence that investors’ appetite for repricings may be reaching their limits as Station Casino’s attempt to reprice their term loan was unsuccessful in early August.

Market Outlook

We find it difficult to make a compelling case for generic credit risk in the current environment. Spreads are either at or not far off multi-decade lows in most North American credit markets. Returns are likely to come mostly from running yields not capital gains going forward. We suspect that if government bond yields were to fall there would be some spread widening to at least partially offset any duration related gains.

While markets have had a solid run year to date, we have seen an increase in new issue supply start to be met with mixed investor responses, with some issues performing poorly despite attractive concessions or relative value.

With technical momentum potentially running out of steam in credit markets (perhaps not in equities), it does raise the prospect of increasing volatility given some poor economic data points from the employment and real estate markets. There appears to be little concern from investors that these data points will prove to be indicative of slowing economic growth in coming quarters. We believe it is not a time for complacency, with credit spreads at or approaching the most expensive levels in a generation, and believe that it’s time for vigilance and discipline, along with selective risk taking when compelling opportunities arise.

Portfolio Metrics

The Fund finished July with long positions of 109.9% (excluding cash and T-bills). 35.1% of these positions are in our Current Income strategy, 74.3% in Relative Value and 0.5% in Event Driven positions. The Fund had a -58.6% short exposure that included -3.2% in government bonds, -37.0% in credit and -18.4% in equities. The Option Adjusted Duration was 1.38 years.

Excluding positions that trade at spreads of more than 500bp and positions that trade to call or maturity dates that are 2027 and earlier, Option Adjusted Duration declined to 0.90 years.

The Fund’s current yield was 5.24% while yield to maturity was 6.42%

Justin Jacobsen, CFA

August 14, 2025

[1] All Pender performance data points are for Class F of the Fund unless otherwise stated. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for the Fund may be found here: https://penderfund.com/solutions/