Highlights

- Verisign, Inc. (VRSN) and Dollar Tree, Inc. (DLTR) were top contributors while Tidewater Inc (TDW) was top detractor to performance.

- Initiated a new position in Addus HomeCare Corporation (ADUS).

The S&P MidCap 400 Index posted total returns of -2.25% for the month of April 2025, underperforming its large cap peer, the S&P 500 Index by 157bps. On a year-to-date basis, the MidCap Index with total returns of -8.21% has lagged the S&P 500 Index by 329bps, creating an attractive investment opportunity in the mid cap space with a forward price to earnings multiple of 14.9x, a 5.4x turn discount to its larger cap peer. The operating cash flow yield for the MidCap Index is also attractive at 5% compared to 3% for the large cap index.

The ongoing earnings reporting season was an opportunity for management teams to share their views on the potential impacts from the reciprocal tariffs instituted by the US Administration in early April. Not surprisingly, a common theme across most earnings calls was that given the unpredictable nature of tariff policy thus far, it has become extremely hard for businesses to plan, not knowing where individual country tariffs will ultimately settle.

One of our portfolio companies in the industrial space mentioned that while projects that have a clear time-to-market driver are forging ahead, some clients that are more sensitive to cost and GDP growth require further market clarity and cost certainty before committing to final investment decisions.

Another holding, a regional bank, increased their allowance for credit losses under the current expected credit loss (CECL) methodology as they increased the probability of a recession to 30%, even though they are yet to see any real credit-related impact from the tariff announcements. This impacted their return on tangible common equity in the quarter by 100 bps as they added around $20 million to provisions for credit losses in the quarter.

However, we continue to believe in the long-term theme of US exceptionalism. Quoting from one of our portfolio company CEO’s letter to shareholders, “The US continues to be an extremely attractive destination for capital. It is the most productive economy in the world with a vast investable universe, leading technological capabilities and a world class talent pool. Going forward, advancements in automation, robotics and AI will usher in a new era and create immense opportunities to buy and completely transform many of these industrial companies at a more rapid pace which will require significant capital and operating expertise. Value creation within industrial operations will be more dramatic and at a faster pace than ever before.”

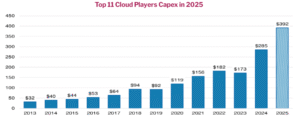

That brings us to one of our key macro themes – Artificial Intelligence infrastructure spending. A Morgan Stanley research update[1] tracking the top 11 cloud providers recently updated their 2025 capital investment projection to $392 billion, based on updated corporate guidance, or 38% YoY growth. This is up $29 billion from a month ago. This equates to 16.6% of revenue, an all-time high. The previous high was 13.1% in 2024, the first year that capex as a percentage of revenue was in the double digits over the last decade. We own several businesses that serve the needs of this growing infrastructure market and stand to benefit as the market continues to grow.

Source: FactSet, Morgan Stanley Research

Notable Portfolio Developments

Verisign was a top contributor during the month. Verisign is a mission-critical operator of several “vertebrae” of the internet. They have exclusive permission to register websites under the .com and .net domain names which has been contractually renewed every six years since 1993. As a registry operator, they are essentially a regulated monopoly overseen by the US Department of Commerce. With the recent contract renewal, they have high visibility into price increases that they can pass on over the next six years equating to mid-single-digit percentage increases annually. This business resilience was demonstrated in its latest quarter during which they increased their 2025 guidance despite a very uncertain macro-outlook[2]. We like the business as its incremental margins are very high (~97%) and its incremental capital outlays are minimal. As a result, average return on assets continues to improve year after year and was a very strong 42% in 2024. VRSN also possesses a predictive attribute we like, being a “Cannibal” company that has repurchased ~47% of its own shares since 2009. We also hold management in high regard with Founder and CEO Jim Bidzos who, having been with the firm since 1995, has a track record on capital allocation and scaling the firm, which we anticipate will continue in the years ahead.

In late March, Dollar Tree announced the sale of its Family Dollar business for slightly over $1 billion. This transaction brings to an end the acquisition that was initiated almost 10 years ago in July 2014 for an enterprise value of around $9.2 billion. This transaction, expected to be completed in a few months, brings much needed clarity and focus to DLTR’s business. Proceeds from the sale will help strengthen the balance sheet and will also be used to buy back shares at what we believe to be attractive prices. At a time of heightened economic uncertainty, DLTR offers value to consumers across the income spectrum and is guiding same store sales growth at 3-5% in the next 12 months, the highest in the last four quarters (this outlook only incorporates the impact from the initial 10% China tariffs)[3]. Dollar Tree stores have had positive same store sales growth each year since 2005, through all economic environments including 2008-09 and 2020-21.

Tidewater is the largest offshore support vessel operator in the world supporting offshore exploration and production of oil & gas. The stock has been under pressure in lock step with the decline in oil prices from a combination of the anticipated decline in demand and increase in OPEC+ production[4]. While offshore production is lower cost and more stable vis-à-vis US shale, we decided to exit our position in the stock as we believe the risks are to the downside if oil prices stay depressed.

New Positions

We initiated a position in Addus HomeCare Corporation, a leading provider of home-based care focused on personal care, hospice and home health services. It serves approximately 48,500 customers – typically elderly, chronically ill or disabled people as well as those at risk of hospitalization or institutionalization. It has posted compounded annual growth of 10% in revenue and 12% in EBITDA over the last three years and its stated goal is to grow revenue by over 10% annually, including through acquisitions[5]. We like the business due to its exposure to industry tailwinds including an aging population, preference to receive care at home (home care is a lower cost option to traditional care settings), a highly fragmented market and supportive legislative trends in key states[6]. The company has a stable and highly experienced management team with a track record of efficient capital deployment.

Outlook

We remain cautious on the market as we look for more clarity around tariff policy and have maintained a higher than usual cash balance as we look for attractive long-term opportunities in which to deploy capital. We believe in our tried and tested investment framework - the companies we own typically have a strong balance sheets, attractive cash flow profiles, proven management teams and are in long-term growth industries that allow them to compound earnings over time.

Aman Budhwar, CFA

May 13, 2025

[1] Morgan Stanley Research Update: US Technology - Cloud Capex Tracker: '25 Growth Now At 38% Y/Y, by Erik W Woodring, Brian Nowak, CFA, Keith Weiss, CFA, Joseph Moore, Meta A Marshall, Dylan Liu. May 1, 2025

[2] Verisign Q1 2025 Earnings Call – 24 April 2025

[3] Dollar Tree, Inc. Reports Results for the Fourth Quarter Fiscal 2024

[4] Tidewater Investor Presentation - May 2025

[5] Addus HomeCare Corp Press Release – February 2025

[6] Addus HomeCare Corp Investor Presentation – November 2024