Highlights

- Modine Manufacturing Company (MOD) and Rambus Inc. (RMBS) were top contributors while Molina Healthcare Inc. (MOH) was a top detractor to performance in the month of July 2025.

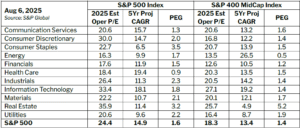

The S&P MidCap 400 Index posted total returns of 1.6% for the month of July 2025, underperforming its large cap peer, the S&P 500 Index, by 62bps. On a year-to-date basis, the MidCap Index, with total returns of 1.8%, has lagged the S&P 500 Index by 677bps, creating an attractive investment opportunity in the mid cap space, with a forward price to earnings multiple of 16.4x, a 6.2x turn discount to its larger cap peer. The operating cash flow yield for the MidCap Index is also attractive at 5% vs 3% for the large cap index.

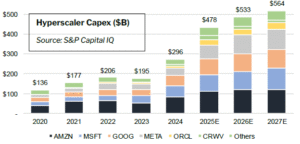

We see Artificial Intelligence (AI) as a key enabling technology for improving productivity. We have several holdings in the portfolio leveraged to this theme and as such we keep a close eye on investments being made in advancing the technology and its widespread adoption. While still early, we are encouraged by progress made by hyperscalers in generating returns on their AI infrastructure investments.

Alphabet CEO Sundar Pichai noted on the recent Q225 earnings call, “AI is positively impacting every part of the business, driving strong momentum. We are investing because we are delivering a lot of value through our cloud offerings. We have very high customer satisfaction; our churn rates are very low. All that gives us confidence we’ll be able to have a healthy ROI on our investments”. Alphabet raised its 2025 capital expenditure outlook to $85 billion, up from $75 billion previously[1].

Similarly, on Meta’s earnings call, Mark Zuckerberg highlighted several benefits, including AI’s ability to unlock greater efficiency and gains across the ad system, creating more engaging experiences, business messaging, Meta AI, AI devices and Quest ecosystem. CFO Susan Li said, “We continue to see very compelling returns from our AI capacity investments in our core ads and organic engagement initiatives and expect to continue investing significantly there in 2026. We also expect that developing leading AI infrastructure will be a core advantage in developing the best AI models and product experiences. So we expect to ramp our investments significantly in 2026 to support that work.” 2025 Capex outlook provided on the call was in the range of $66 billion to $72 billion, up $30 billion year-over-year at the mid-point, and they expect a similar significant capex dollar growth in 2026[2].

Notable portfolio developments

- Modine Manufacturing’s stock was the top contributor for the month after raising its fiscal 2025 (year ending March 2026) revenue and EBITDA guidance on strong data center results. MOD designs and markets thermal management solutions like air chillers and coolant distribution units which are mission-critical inputs for data centers. MOD expects its data center business to grow +45% in fiscal 2025 and at a CAGR of >30% through the fiscal year ending March 2028[3]. Management has actively deployed capital into higher return areas while exiting less profitable / lower growth areas, for example its recently announced plans to invest $100 million to expand data center revenue capacity by ~$1 billion at a >40% return on capital. This is consistent with our focus on firms with durable avenues to deploy incremental capital at high rates of return.

- Rambus was also a top contributor in July following stronger-than-expected results for the quarter ended June 30, 2025, as it continues to benefit from the data center opportunity with an expanded product portfolio. Product revenue, driven by memory interface chipsets (the bridge between processors and memory modules designed to ensure that memory is accessed quickly, reliably and in the right format), rose 43% year-over-year as RMBS gained market share and launched new products[4]. The company is also benefiting from a growing trend among AI players to design custom Application Specific Integrated Circuits (ASICs) — specialized chips that outperform general-purpose GPUs for AI workloads — where Rambus supplies high-speed interface Intellectual Property. We view Rambus as a core holding given its asset-light, R&D-driven business model which generates high returns on incremental capital. We believe its strategy to broaden its chipset portfolio and deepen relationships with its clients positions it well for continued growth.

Even while all these impressive AI infrastructure investments are being made, US factory activity marked the fifth consecutive month of contraction. According to the Institute for Supply Management’s monthly survey, manufacturing PMI registered at 48 for the month of July, below the 50 score that differentiates growth and decline.

The blame for this manufacturing contraction can be partly attributed to reluctance amongst businesses to invest in the face of uncertainty caused by rapidly changing import tariffs. The effective average tariff rate on all imported goods now stands at roughly 18% versus 2.3% last year, the highest level since the 1930s.

Speaking at their earnings call, the CEO of Fluor Corporation (FLR) said, “Near term, in semiconductors, our clients' investment intentions have not yet translated into meaningful new awards. In mining and metals, while the fundamentals for capital spending by our clients remain very strong, the immediate enthusiasm for major capital deployment is currently tempered by the potential impact of global trade uncertainty. In energy solutions, prospects for the next few quarters are expected to be modest as the reload we discussed for 2025 is taking longer than expected. This is due to several factors, including reduced CapEx budgets, trade uncertainty and soft battery and chemicals markets”[5].

We remain bullish on our portfolio holding in Fluor as it seeks to monetize its stake in NuScale Power Corp in the short term and benefits from growth in its end markets in the long term. We expect opportunities from AI infrastructure investments as this market continues to expand and several of Fluor’s other end markets will rebound from the short-term softness as more clarity emerges around tariffs and potentially lower US interest rates act as a tailwind for capital investment.

A stock that disappointed during the month of July was Molina Healthcare, a pure play government sponsored managed care franchise with operations across 21 states in Medicaid (79% of revenue), Medicare (15%) and Marketplace (6%). They have been impacted by the magnitude and persistence of increased medical costs that started in the third quarter of 2024. The per member/ per month rate paid by state governments is designed to reflect cost trends, but with a lag of a few quarters. Management is hopeful that with 55% of the Medicaid book coming up for renewal on January 1, 2026, rate increases will catch up with the increase in costs. Being an efficient operator, Molina has Medicaid medical cost ratios 200-300 bps lower than the broader market and thus should be able to recover from these cost pressures earlier than some of its peers[6].

Outlook

As mentioned above, the US economy is bifurcated between strong growth in AI driven infrastructure investments on the one hand and softness in manufacturing capital investment on the other. Management teams have been devoting their attention to navigate the rapidly evolving tariff landscape and have been reluctant to commit to new capital projects, preferring to buy back stock instead. US companies have announced $984 billion worth of stock buybacks so far this year, the best start to a year on record according to Birinyi Associates data going back to 1982[7]. They are projected to purchase more than $1.1 trillion worth overall in 2025, which would mark an all-time high.

We believe more clarity around tariffs and potential Fed rate cuts by the end of the year will be positive for the economy and for the more domestic focused small/mid cap stocks. We see an opportunity for these stocks to catch up with their large cap peers as the slight difference in projected earnings growth narrows and the discount in price earnings multiples becomes even more compelling.

Aman Budhwar, CFA

August 18, 2025

[1] Alphabet Q2 2025 earnings call July 23, 2025

[2] Meta Q2 2025 earnings call July 30, 2025

[3] Modine Manufacturing Q2 2025 earnings call July 31, 2025

[4] Rambus Q2 2025 earnings call July 28, 2025

[5] Fluor Corporation Q2 2025 earnings call August 1, 2020

[6] Molina Healthcare Q2 2025 earnings call July 24, 2025

[7] American Companies Are Buying Their Own Stocks at a Record Pace, WSJ